Elon Musk, the CEO of electric-car startup Tesla Motors and rocket-launcher SpaceX, should be applauded for the mighty challenges he's taken on and the powers of persuasion he has deployed to build his companies. But along the way, he discovered that he could stretch the truth, casually and frequently, as a shortcut to getting things done.

Clad in a sheen of bubbly optimism, his mendacity nonetheless has consequences. Through Tesla's IPO, he has now taken hundreds of millions of dollars from taxpayers and public investors who expect not just a return but square dealing from the man who is managing their company for them.

So where has Musk spun the facts?

Critical reporting

Well, let's go with the most recent one: He's lied about me, and VentureBeat, apparently in retaliation for our aggressive and accurate reporting.

In an article published by the Huffington Post, he calls me "Silicon Valley's Jayson Blair." He accused me of making errors, but never once specified them. Here's the truth: I cited Musk's own words from court filings, which we had paid a freelance reporter to find and copy, legally, from a courthouse in Van Nuys, Calif. I also interviewed a host of other sources. I emailed Musk questions and called his lawyer repeatedly before publishing. We went to extra lengths to nail down the facts: Before publishing, VentureBeat editor-in-chief Matt Marshall called Musk and had interviews with at least three Tesla board members.

We make no apologies for seeking the truth about Tesla Motors and Elon Musk, a vital company and an iconic entrepreneur of Silicon Valley. Our reporting (here's one example of our series) helped investors get a more truthful picture of a company that was going public and the man behind it.

Musk also accused me of "collaborating" with the lawyer representing Justine Musk, his ex-wife, in their divorce case. Also false: I picked up the phone and called her lawyer, and he had the courtesy to answer my questions.

Now, we should all be used to Musk insulting journalists who don't report what they're told to. But calling someone a "Jayson Blair" is a troubling assertion to anyone who prefers his insults to have a factual basis.

When I ran fact-checking at Business 2.0 magazine, here's what I would have asked the writer to prove before I'd let him get away with that kind of factual assertion: So, you want to compare this Owen Thomas person to one of journalism's most infamous miscreants. Is Owen Thomas a drug addict? Is Owen Thomas mentally unstable? Has Owen Thomas plagiarized or invented facts? The answer to all of those, in case you were curious, is no.

And so out comes the chief of reporters' red pen.

The one specific claim Musk made about my reputation was that I had written that he was broke. Not true. If you review the story I reported on his personal finances and their impact on Tesla, you'll see I merely quoted Musk's own words from his divorce filing, in which he said that he "ran out of cash."

When VentureBeat first started raising questions about Musk's personal finances, his expensive divorce case, and the impact they might have on Tesla's IPO, a Tesla spokesman initially said that the company had no plans to update its IPO prospectus to reflect our reporting. However, in the end, Tesla updated its SEC filings to acknowledge substantially all of the concerns we raised as potential risk factors investors should consider.

That is the ultimate correction of the record, and it stands today.

Musk's personal spending

There are other whoppers in Musk's piece, such as the suggestion that of the $200,000 per month he's spending, a mere $30,000 a month is going to his own personal household expenses, with the rest going to legal fees in his divorce case. Actually, the figure he told a court is $98,023 a month, according to filings in that case, including $50,000 a month in rent.

The founding of Tesla Motors

An aside to Musk: Making false statements is something the law frowns on.

Oh, but wait, Musk should already know that. He and I met in San Francisco in 2008 for drinks, and over the course of the evening, he made several disparaging remarks about Tesla Motors cofounder Martin Eberhard's management of the company before Musk had ousted him as CEO -- specifically, Musk alleged, for misrepresenting the cost of making the Tesla Roadster. In 2009, Eberhard sued Musk for defamation, citing the comments Musk had made to me, among others. Musk filed a scathing response to the lawsuit, repeating many of his negative claims about Eberhard.

Then it headed to mediation, and the case was settled. Eberhard's lawyer declared himself "very pleased" with the result, and Tesla issued a press release in which Musk said that Eberhard had been "indispensable" to the company in its early days.

The safety of customers' deposits

When Tesla's finances were at their most perilous, in the winter of 2008 and spring of 2009, the company was dependent on advance reservation payments from customers for cash flow. The company's cash balance had run down to $9 million, and the company was struggling to raise $40 million in convertible debt. (He announced that that round had closed in November 2008, while in fact, according to Tesla's SEC filings, it did not close until March 2009.) To raise funds in the meantime, Tesla began taking deposits on the Model S sedan, even though that car was far from production, and continued taking deposits on Roadsters. Musk first told customers that he would personally guarantee the deposits they were placing, "even in the worst case of an Armageddon scenario." Then he said that their deposits were completely at risk and they could lose all their money. One of those statements had to be false.

Musk's history as an entrepreneur

In persuading other investors to back Tesla Motors, Musk has frequently traded on his past success as an entrepreneur at companies like Zip2 and PayPal. But Zip2 was so troubled that one of its venture capitalists, Derek Proudian, had to step in as acting CEO, a move rarely seen at venture-backed companies. And Musk was ousted as CEO of PayPal by his own management team. To this day, Musk tells a version of PayPal's history that few who were there at the time agree with.

Tesla's investors

Most dangerously, Musk has repeatedly made misrepresentations about Tesla's finances. In February 2009, he sent a letter to customers saying that Tesla would start getting funds from a Department of Energy loan in four to five months. In fact, it had not received the loan at that point and there was no certainty it would get it, a point a Tesla spokeswoman had to clarify. (Tricky, that, saying your CEO had misrepresented the facts without calling him a liar.)

He also said Tesla would turn profitable in 2009. Of course, it didn't, as the company's published financials later revealed. (Musk later claimed, using questionable accounting whose details have never been revealed, that the company had been profitable for one month of the year.)

In an interview for the May 2009 issue of Car and Driver, he told that magazine's readers that General Electric had become an investor. It hadn't, and it never did, according to Andy Katell, a GE spokesman who spoke with me at the time.

The Toyota deal

After unveiling an agreement to buy the NUMMI plant in Fremont, Calif., from the Toyota-backed joint venture which owned it, Musk claimed that Tesla and Toyota planned to jointly develop several models of cars and build them at NUMMI. It's true that he got Toyota CEO Akio Toyoda to stand next to him and make grand promises. But in fact, as the company later revealed in its SEC filings, Tesla and Toyota had no agreement to develop any cars, and there was no guarantee that they ever would.

The pity of it all is this: I don't believe Musk twists the truth out of malice. Rather, at this point, it may well be out of habit. He's so used to getting his way that future possibilities just seem like present realities to him. And pragmatically, it's worked. Whenever Tesla has been in a bind, Musk has spun his way out of trouble.

It's a character trait of which elements are found among many successful entrepreneurs: the compelling presentation of an alternate reality in the hopes that so many people will sign on to the vision that it comes true. Apple CEO Steve Jobs, for example, is so masterful at this that people speak of his reality distortion field. But Musk may have taken distortion to extremes.

The question now is whether Musk's past habits will serve him well as the CEO of a publicly traded company. Already, it seems the investors who have entrusted Musk with hundreds of millions of dollars are having doubts. With shares of Tesla having already fallen by nearly half since their post-IPO pop, perhaps Musk's bubble is finally deflating.

But those who are still sticking with the company should ask themselves this: Has Tesla adequately disclosed to investors the risk of its CEO's curious relationship with the truth?

Originally posted at VentureBeat.

As you’ll read tomorrow (or Monday), I’ve entered a new phase in my life. After years of hard work and long hours building this blog (time that I’ve enjoyed), I’ve been shifting things around so that I have more free time. As a result, I’m going to have more time to devote to creating quality blog posts, instead of rushing around at the last minute looking for something to write about.

Because of this, it’s time yet again to take requests. I do this about once a year, and it’s a great way to get a feel for what GRS readers are interested in. I’d be grateful if you’d take the time to leave a comment below with topic suggestions or article requests. It doesn’t matter if we’ve covered the subject in the past. If you’d like me (or one of the other GRS staff) to write about it, let me know.

Have there been too many articles about credit cards? Too few articles about credit cards? Would you like to know more about individual savings accounts? Do you like the articles about the psychology of spending? Would it be helpful to have somebody come in to explain insurance concepts in plain English? Should I try to persuade my wife to share more of her recipes now and then? Let me know what you’d like to read about!

While you’re all providing feedback about the site, here are a few recent articles of note:

Over at The Simple Dollar, Trent and his readers had a thoughtful discussion about the obligations of wealth. “I think there is some inherent distrust of the rich in the mainstream of American society,” Trent writes as he describes how a wealthy person can keep from alienating his friends. There’s so much to say about this topic; I’m tempted to write an entire article about it.

GRS reader Steven writes a blog called Hundred Goals, which is about achieving your goals while managing your finances. After Sierra’s post this morning about travel, he dropped me a line to let me know that he has a recent article about how to have a great vacation.

Speaking of vacation, my pal Jason over at No Credit Needed spent time compiling day-use fees and free days for state parks across the United States. Handy page to bookmark!

And here’s more travel! At The Art of Non-Conformity, my good friend Chris Guillebeau has posted a beginner’s guide to travel hacking. I’ve been asking him to share this info for a long time; now I’ve got to take responsibility to use the knowledge he’s shared.

Finally, I’ve been giving a lot of interviews lately. I’m much more comfortable with these than I used to be. (They used to scare me to death!) Some examples:

- Colleen from The Frisky interviewed me about how to save money even when you’re living paycheck to paycheck. This is a tough quandary, something I’m asked about a lot.

- In an interview with BeFrugal, I discuss frugality, happiness, and conscious spending. (Note: “the ballot” should be “the balance” — I must have mumbled.)

- Jeff Rose at Good Financial Cents also interviewed me. This interview is very much about the process of writing a book, which may or may not interest you.

- I also spoke with Beverly Harzog from Card Ratings. We chatted about credit cards, of course, but also about other aspects of personal finance.

- Finally, USA Weekend has a short piece on how to give your 401(k) a midyear check, for which author Richard Eisenberg interviewed me back in May. This is a perfect example of how much work goes into even a small newspaper article. Eisenberg spent 20-30 minutes on the phone with me, and I’m sure he did the same with the other folks he quotes. Plus, I’ll bet he spent a lot of time writing. I wouldn’t be surprised if there were 4-6 hours in this small piece.

Okay, one last thing before I go. Tim pointed me to a two-year-old New York Times series about the debt trap, which includes an interactive infographic showing average household debt loads over the past century.

That’s enough links for today. Please do leave a comment with topic requests or other feedback. Meanwhile, it’s time for me to go do some yardwork…

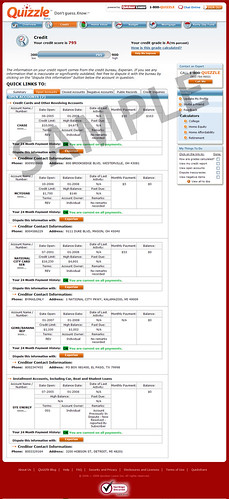

internet marketing course Organizing your personal finances can be a headache. There are several reasons a person might not wish to organize their personal finances: they may fear what they will uncover, they may have a rather large pile on the desk of bills, receipts and statements or they might just feel overwhelmed with the idea of categorizing all of the different bills they have. Organizing and managing your personal finances is the first step to financial freedom.

Here is one way that will help you understand how to organize all of your finances.

Begin by gathering all of the statements, bills and other paperwork that might be sitting on your desk. Get it all together so that you can begin going through all of it. This may seem overwhelming at first, but once you set up your method of organization, it will go quickly.

Now, you should buy a file cabinet or a small filing bin. Purchase one that allows you to use hanging folders. Then, pick up some manila folders to put in these filing folders. Make sure you have at least 10 hanging folders and enough manila folders to cover all of your accounts.

Label your hanging folders with the following categories:

Credit Card Debt

Insurance

Loans

Utilities

Housing

Investments

Retirement

Tax Information

Credit ReportsNow, it is time to sort this out. Each of these folders will contain manila envelopes as follows:

Credit Card Debt - make one manila folder per credit card. Hopefully you have been diligent in paying your credit card debt down, but if not you will want to label your each credit card name in RED pen. This will make them stand out, and will remind you to take care of this bill as soon as possible. The danger of credit card debt is a whole other topic! Now, with each folder having a credit card name on it, place any related statements into these folders. You now should have a place for each piece of credit card related mail. Keep only the essential things, privacy statements, rate increases and monthly statements to keep the file nice and tidy.

Insurance - In this hanging file you should include manila folders labeled: home/renter’s insurance, car insurance, life insurance, medical insurance, and dental insurance. Place statements, bills or policy paperwork into the appropriate folders. This will likely be a hefty sized folder since many insurance companies send lengthy policy notices.

Loans - This hanging file will include such items as student loans, car loans, personal loans or other loans you might owe. It should not include your mortgage loan, as this is included in the housing file. If you have decided to have loan payments directly deposited from your bank account, place this paperwork in the files also as it will help if you need to go back to change the amount.

Utilities – This hanging file is pretty basic. It will include utility bills such as water, energy, heat and sewage. In this folder you should also include items like cable, internet and phone. This will be the folder in which you keep everything related to running your apartment/home.

Housing – This is the folder to use for your mortgage loan, or any paperwork you may have regarding an apartment you are leasing. Be sure to put your lease paperwork, including the lease you signed in this folder. It will be easily accessible if there is a problem with your apartment. If you own a home this is a good place to put a folder for repairs or remodeling. If you keep track of your expenses you may be able to use this information for tax purposes when you sell your home.

Investments – This folder should contain information about any checking, savings or investment accounts you may own. You should make a separate manila folder for each bank account you have, and each separate investment. Be sure to place bank statements in these folders monthly.

Retirement – Any information you have for a 401K, IRA or other retirement documents should be in this folder. If you have more than one retirement plan, be sure to make a separate folder for each of these as well.

Tax Information - Keeping your tax returns from year to year is essential. Label folders starting with the most recent tax year all the way back to when you first began filing taxes. Give each year it’s own folder to keep things nicely organized. You should make a folder for tax deductible receipts as well. This will come in handy when it is time to do your taxes and itemize your deductions.

Credit Reports – The Fair Credit Reporting Act now mandates that you can receive free credit reports, up to 3 per year. Check out this site: http://www.ftc.gov/bcp/conline/pubs/credit/freereports.htm You should run this regularly and keep them on file. This is something that you can refer back to as well to see how your credit is improving.

So that is it! That is how easy it is to organize your personal finances. Now, the key is to manage them. When you pay your bills, be sure to make it a habit to file away the statements or any other information you receive in the mail. Keeping up with filing will change your financial life and will make the overall picture much clearer for you. You will find that after you do this, it is much easier to sort though your files and knowing what you owe is much clearer.

penis enlargementAt Apple Inc., "working our butts off" means cots in the engineering department and cars in the parking lot at all hours of the night. Seeking a solution to the antenna flaw that is dropping calls for some iPhone 4 users, ...

That hilarious animated Taiwanese news segment on Steve Jobs and the iPhone 4 we posted earlier now has English subtitles, thanks to reader Michael Chang. It shows Jobs defeating Bill Gates in a lightsaber battle and donning a Darth ...

These are my links for July 15th from 12:27 to 12:32: Herpes invasion - There are eight herpes viruses ...

how to lose weight fast